Disney vs. Netflix: Who's winning the streaming war?

Predict which will have more subscribers mid-way through 2023.

Welcome to Nonrival, the newsletter where readers make predictions.

How it works

On Sundays, read the newsletter and make a forecast by clicking a link at the bottom.

On Wednesdays, see what other readers predicted and how your forecast compares.

Over time, you’ll get scores based on how accurate your forecasts are.

In this issue

Make a forecast: Who will have more streaming subscribers, Disney or Netflix?

Thanks for forecasting. Send feedback to newsletter@nonrival.pub .

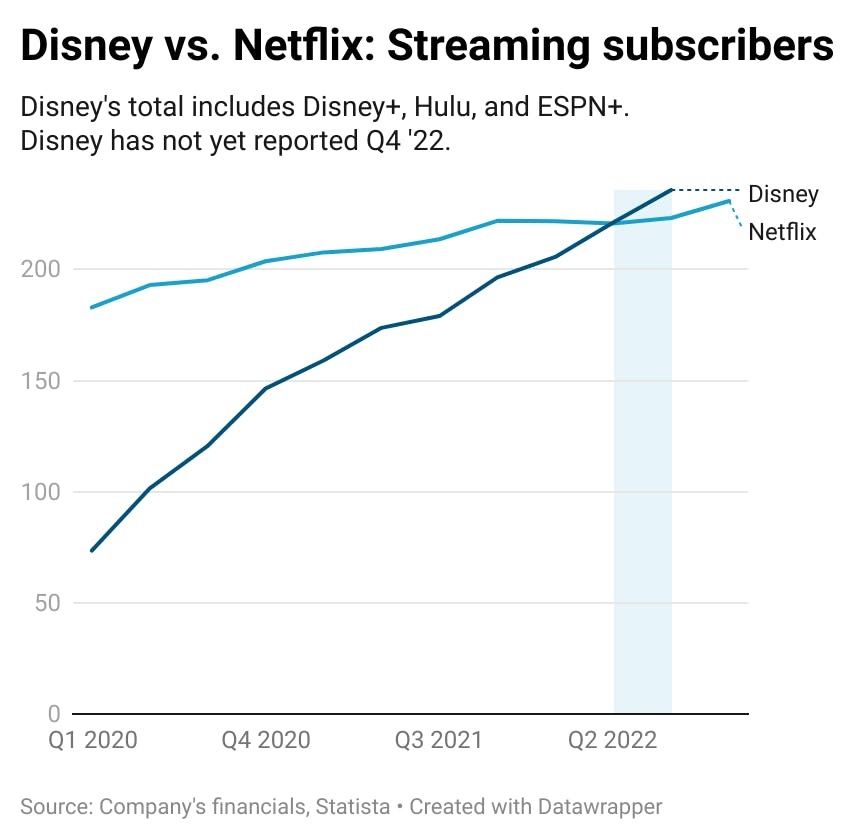

Disney vs. Netflix

The world’s two most successful streaming companies are mirror images of each other: Disney’s creative strategy is relatively clear but its business model is a sprawling mess. Netflix’s creative strategy is a sprawling mess but its business model is relatively clear. Which problem would you rather have?

This week’s Economist cover is dedicated to Disney’s struggle to balance its massive streaming losses with its fading movie and cable TV businesses, all while not screwing up its theme parks. On the creative side things are clearer: The company, which will turn 100 later this year, bases everything around recognizable characters and franchises, from Mickey Mouse to Star Wars to Marvel.

Then there’s Netflix, whose head of television, Bela Bajaria, was the subject of a long feature in last week’s New Yorker . Its entire business is selling streaming subscriptions (now with the minor complication of an ad-supported tier). But its creative strategy is muddied by the desire to offer more of everything to more of everyone.

Both companies are coming off of a rough 2022 and both recently announced leadership shakeups. The competition between them will be a major plotline in the streaming wars’ next chapter.

This week’s forecast is about who will take the lead:

How likely is it that Disney will have more streaming subscribers than Netflix at the end of Q2 2023?

Background

Disney

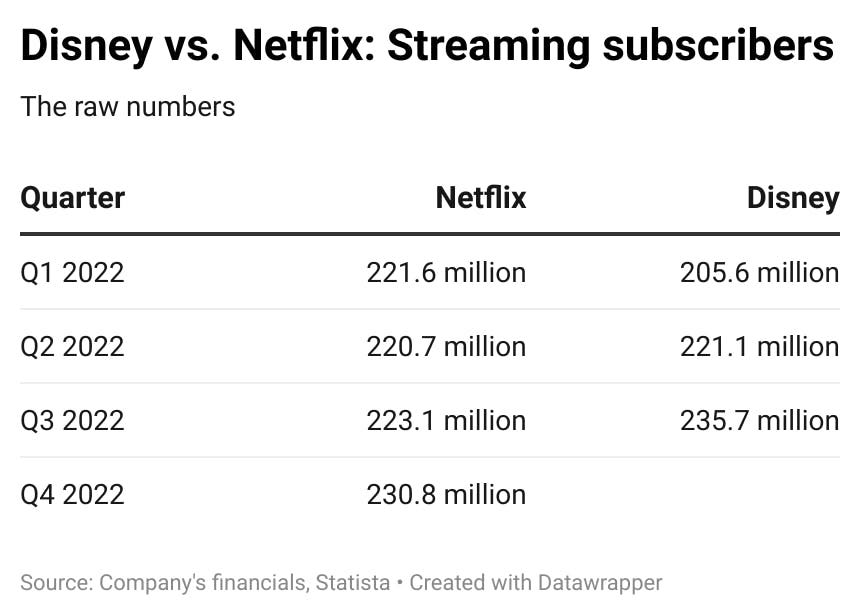

Streaming business: Disney’s streaming empire spans Disney+, Hulu, and ESPN+ — with Disney+ representing about 70% of its subscribers. In the US, it brings in about $6 in revenue per Disney+ subscriber.

Corporate view: Disney’s streaming unit lost $1.5 billion in Q3 , which was enough to oust its CEO Bob Chapek and bring back former CEO Bob Iger. The company owns too much stuff to name: Marvel, Star Wars, Pixar, ABC, ESPN, Hulu, and more. Its cash cow, ESPN, is perennially in rumors to be spun off , and its park pricing decisions have come under fire from fans.

Person to know: Bob Iger is back because if you can’t be president and you can’t own an NBA team you may as well run Disney again. Iger loves buying companies —Pixar, Marvel, Star Wars, 21st Century Fox—but what Disney really needs is a successor.

What to watch for: Disney+ raised its US monthly price by $3 in December. Will Iger back away from the company’s goal of adding another 50 million subscribers in 2023 while the company focuses on cutting its losses?

Netflix

Streaming business: Netflix lost subscribers for the first time in the first half of 2022. But it grew again in the second half and finished 2022 with 231 million paid memberships , globally. Its prices vary around the world, but in the US and Canada it reports about $16 in revenue per subscriber.

Corporate view: In November, Netflix backtracked on its no-ads promise, launching an ad-supported subscription for $6.99 a month in the US. It plans to crack down on password sharing in the first quarter of 2023.

Person to know: Greg Peters was promoted to co-CEO this past week, replacing founder Reed Hastings, who will become chair. Peters was chief product officer and COO, and also oversaw the company’s new ad business and its nascent gaming business .

What to watch for: Will the coming password-sharing crackdown boost subscriptions, or will it push sharers to decamp to other services?

Indicators

Here's the raw data for 2022:

Perspectives

Maybe the worst is over for Netflix

“There was this massive surge in [streaming] competition that now is going to slow down as everyone retrenches… That’s a nice inflection point, where it was bad for Netflix but it’s going to start to ease up. On top of it, having a cheaper advertising plan—even if most consumers don’t want it—is going to be great from a marketing standpoint, especially as you crack down on password sharing.” —Rich Greenfield on the Plain English podcast, Jan. 2023 (min. 18)

Or, maybe Netflix is losing cred in Hollywood

“I had Netflix team pride,” [Bojack Horseman creator Raphael] Bob-Waksberg said, adding, “I cannot imagine another time or place where ‘BoJack’ got the acclaim and number of seasons that it did.” At some point, though, he noticed that the platform was auto-skipping the credits of the show. In a product meeting, he raised an objection, and an executive explained that doing so helped viewers breeze through episodes. As Bob-Waksberg recalled it, he joked that they might as well simply eliminate the story line of Princess Carolyn, one of five protagonists, to which the executive replied, “Who is Princess Carolyn?” Bob-Waksberg told me, “That’s when I knew it was the beginning of the end.” —Rachel Syme, The New Yorker, Jan. 2023

Might Disney sell Hulu?

As part of a deal struck when Iger was still at Disney, Comcast has the right to sell off its one-third stake in Disney-run Hulu as soon as 2024. Most industry insiders figured it was a no-brainer that Disney would want to do this sooner rather than later… [But] Greenfield, [an analyst], is once again arguing what Iger should actually do is get rid of Hulu altogether.” —Josef Adalian, Vulture, Nov. 2022

Forecast

The fine print

Resolution criteria:

This question will be resolved using the company's public financial reporting.

Disney uses its own weird fiscal year calendar but this question will resolve using the quarterly data reported after the end of June 2023.

Disney's subscriber reporting currently includes Disney+, Hulu, and ESPN+ combined. If it sells one of those units then its total would no longer be included. Likewise, any acquisitions that it includes in its consumer streaming reporting would be included.