Welcome to Nonrival, the newsletter where readers make predictions.

How it works

On Sundays, read the newsletter and make a forecast by clicking a link at the bottom.

On Wednesdays, see what other readers predicted and how your forecast compares.

Over time, you’ll get scores based on how accurate your forecasts are.

Table of contents

Thanks for forecasting. Send feedback to newsletter@nonrival.pub.

Introduction

Even by the standards of crypto, phew, what a week. In 10 days, FTX went from one of the biggest, most mainstream players in the sector to announcing bankruptcy. Will the crash cause investors to rethink their interest in crypto? That’s the question animating this week’s forecast, and it’s a major piece of the narrative that this is “crypto’s Lehman moment.”

You can see the logic: This was plausibly one of the largest bank runs in history, and it may be the biggest single loss for venture capitalists ever. Maybe institutional investors have seen enough.

On the other hand, a lot of investors are bought into the potential of blockchain and web3. And the reports of mismanagement and potentially worse at FTX might convince even relatively risk-averse institutions that the problem was the company not the sector. Or, put it this way: If all the previous swings and scams and hacks weren’t enough to persuade an investor to steer clear, is this really going to change their mind?

This week’s forecast looks at this question through one key sector for funding crypto: venture capital.

Will venture capitalists give up on crypto?

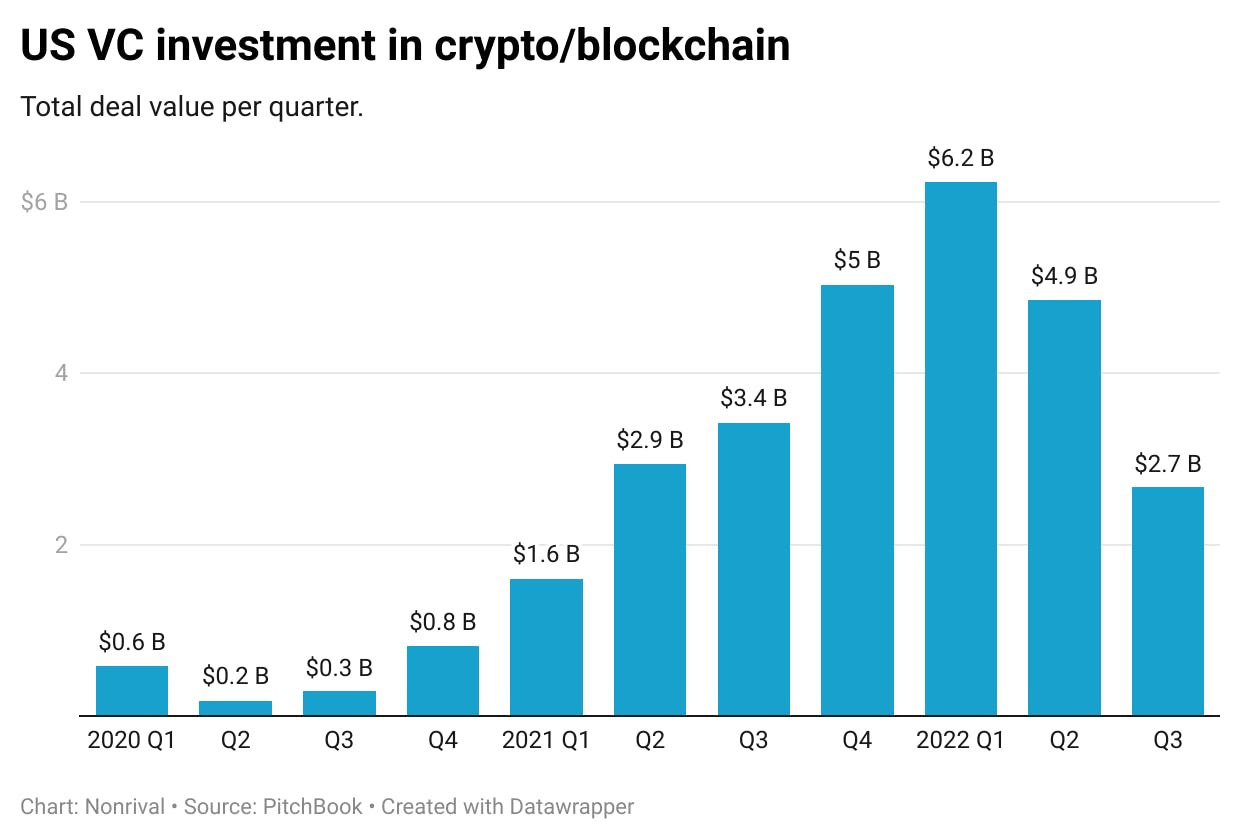

Specifically: Will US venture capital investment in crypto exceed $2 billion in either Q4 of 2022 or Q1 of 2023?

Make a prediction at the bottom of this newsletter.

Background

Last week, FTX was the third-largest crypto trading platform worldwide. Its 30-year-old founder, Sam Bankman-Fried (SBF) “was the most important person in crypto,” The Economist wrote this week. FTX, which he founded in 2019, was headquartered in the Bahamas, with a US-based affiliate, FTX US.

FTX and SBF spent billions on a major marketing push over the last year, to establish the company as mainstream and respectable among policymakers, investors, and consumers. (SBF took an interest in forecasting through his philanthropic efforts but has no financial connection to this newsletter.)

Along the way, FTX raised just under $2 billion from investors, including well-known VC firms like Sequoia and Wall Street staples like BlackRock. They did not receive any board seats and those investments are now worth zero.

FTX acquired multiple distressed crypto firms earlier this year. At least one of them is now searching for a new acquirer.

So… then what happened? FTX lent billions in customer assets to Alameda Research, a hedge fund also founded by SBF, according to the Wall Street Journal. A news report revealed that Alameda owned lots of the crypto token FTT, issued by FTX. After which a competitor—Binance—announced that it would be selling its FTT holdings, which seemingly set off a flood of withdrawals that took FTX down. The exchange held just $900 million in liquid assets—half of it stock in one company—against $9 billion in liabilities, the Financial Times reported Saturday.

Coinbase, the US-based, publicly-traded crypto exchange, told investors last week that it had no exposure to FTX and that it was not vulnerable to bank runs because it does not lend out customer assets. Its stock price dipped on the FTX news but has mostly recovered.

Timeline

Wednesday, Nov. 2: A report from the news site Coindesk raised doubts about FTX’s balance sheet.

Sunday: FTX’s main competitor Binance announced it would be selling all its holdings of FTX’s crypto token.

Monday: FTX’s founder said the company was fine.

Tuesday: Binance said it planned to acquire FTX.

Wednesday: Binance changed its mind.

Friday: FTX filed for bankruptcy and its founder and CEO resigned.

More detail on the timeline from Reuters.

Perspectives

From around the internet…

“The collapse of FTX may be enough to reverse the embrace of crypto by institutions… Legislators will now eye crypto with even deeper suspicion. Whatever the precise cause of FTX’s implosion, the story is already a tragedy for the industry.” —The Economist, Wed. Nov. 9

“Booms and busts are common in crypto, but never anything close to this magnitude. At the very least, the FTX experience will put a major chill on venture investment in crypto, even in unaffected areas like decentralized finance. If FTX can go from $32 billion to (maybe) zero in just 36 hours, who's to say the same can't happen elsewhere? Why would LPs take the chance?” —Dan Primack, Axios, Wed. 11/9

“This is going to destroy institutional interest in crypto for years to come.” —Joe Weisenthal, Bloomberg, Thurs. 11/10

“The collapse and loss of $2 billion would rank second [among venture-capital losses, all-time.] We expect investment capital flowing into the crypto space to recede in 2023. Crypto VCs have raised more than $40 billion over the past two years to fund crypto companies, but the pace of investments should slow considerably… Still, we believe the long-term prospect for crypto and blockchain technologies remains favorable.” —Robert Le, PitchBook, Thurs. Nov. 10

“Venture capitalists see the moment as a warning, but also as an opportunity for the growth of decentralization and maturation of the larger blockchain space.” —Jacquelyn Melinek, TechCrunch, Wed. Nov. 9

“When guessing at the future of crypto, keep in mind that the future of crypto exchanges and the future of crypto assets are very different things. For many pure crypto bugs, the exchanges are a sellout and a concession to older methods of finance and settlement.” —Tyler Cowen, Bloomberg Opinion, Fri. Nov. 11

Nonrival also asked several VCs for their perspective:

“In the wake of the FTX implosion, I think VCs are going to be doing two things differently — (1) being tougher on founders with respect to governance and transparency (“trust but verify”, as Ronald Reagan said to Gorbachev) and (2) being more skeptical of the timing of mainstream crypto adoption given the dramatic impact on trust in the broader ecosystem.” —Jeffrey Bussgang, Flybridge Capital Partners, Fri. Nov. 11

“I think the crypto cowboys are going to have a hard time in this market but experienced operator-VCs that are investing in businesses that leverage the technologies and philosophies of web3 are going to do just fine. The train has left the station and it's clear that the ownership economy is going to drive new innovations and business models over the next decade. The crypto winter that now will probably be darker and deeper due to FTX will lead to lower valuations and thus higher likelihood of long term expected returns… It's clear venture investors need to be more hands-on with respect to governance - and overall that's probably a good thing to come out of all this.” —Nick Ducoff, partner at G20 Ventures, Fri. Nov. 11

“Rogue leadership, misuse of customer deposits, zero corporate oversight, and dishonesty will destroy any company in any sector. We don't think the issues here actually had anything to do with crypto. With that said, FTX was a major player in the crypto space and as a result, their actions will create a negative cloud over the industry and feed the nay-sayers. Our investment thesis remains unchanged and we will continue to partner with dynamic founders to build high-utility crypto projects.” —Parker McKee, principal, Pillar VC, Fri. Nov. 11

“I'm still shocked how little controls were put in place… The main thing I'm watching is how institutionals and the non-crypto tech community responds. Because it hit so many big, trusted brands in VC like Sequoia, Lightspeed, and NEA as well as celebs like Tom Brady, it's causing a lot of institutional LPs who were getting comfortable with crypto to now turn on it. Sequoia's loss itself is a rounding error on their overall funds, but when what's regarded as one of the top names in VC loses $420m in one year in a very high-profile fraud, that raises a lot of questions.” —Drew Volpe, managing partner, First Star Ventures, Thurs. Nov. 10

Indicators

For more on how VC is faring overall, beyond crypto, read Nonrival’s Oct. briefing.

Forecast

Six more months of crypto winter?

Update 11/15/22: Last week, amid the spectacular implosion of FTX, Nonrival asked whether VCs would shy away from crypto. Specifically: Would they invest $2B or more into US crypto startups in either Q4 or Q1. Your view: Probably not.

Most readers see macro factors dragging all of VC down for the next couple of quarters—tellingly, that backdrop was mentioned more in the most skeptical forecasts than anything about FTX. But the consensus seems to be that FTX won’t help, and that on the margin it will chill investment in the sector.

Readers’ reasoning

The case for a long crypto winter:

10%: Investment is already trending below $2 billion per quarter thanks to crypto winter. This won’t help.

25%: If there was significant investment in October 2022 before FTX blew up, that's still Q4, so it's possible. Post-FTX, the likelihood in the near term is very low. Investments will continue at a slower pace with a lot more scrutiny by investors, who will demand board seats and favor companies operating in more highly regulated jurisdictions, and many may choose to wait six or so months until there's more clarity on regulation or on the timing of the end of this crypto winter. The knock-on effects of FTX's meltdown still need to work their way through the system, too.

35%: A chilling effect for several months seems likely, but markets are hard to predict and loony VCs doubly so

And the case that VCs will be undeterred:

50%: I expect overall funding activity to increase slightly, but mostly for earlier stage companies. I think VCs are pretty undeterred - especially ones that continue to play the semi-legal game of selling tokens that they acquire via funding rounds, like a16z.

51%: In favor of less: Big fuckup. In favor of more: $2B isn't that much money, particularly with inflation. There are two possible period where it could happen. I started with a 30% that it could happen for each quarter. This gives a (1-0.3) * (1 - 0.3) = 0.49 = 49% that it would not happen in any of the two quarters, or a 51% that it will happen.

60%: Mostly this will be seen as FTX specific. At most, it’ll dampen enthusiasm for crypto trading. But if VC overall stabilizes as I expect, I think plenty of VCs will still back web3 companies.

Manifold Markets

You can follow a version of this forecast on Manifold Markets to see what their users think in real-time:

Or, make your own forecast:

Fine print: This question will be solved by PitchBook’s analysis of US VC Deal Activity in Cryptocurrency/Blockchain following the release of Q1 2023 data.