Startup funding keeps falling & the US credit rating is at risk

Debt ceiling forecasts compared, plus resolving the Q4 VC forecast.

Welcome to Nonrival, the newsletter where readers make predictions.

How it works

On Sundays, read the newsletter and make a forecast by clicking a link at the bottom.

On Wednesdays, see what other readers predicted and how your forecast compares.

Over time, you’ll get scores based on how accurate your forecasts are.

In this issue

Debt ceiling forecasts compared.

Venture capital in Q4: October forecasts resolved.

Thanks for forecasting. Send feedback to newsletter@nonrival.pub.

Debt ceiling drama, continued

Here's the New York Times on Tuesday:

Big investors and bank economists are using financial models to predict when the United States, which borrows money to pay its existing bills, will run out of cash. They are assessing what it could mean if the government is unable to pay some of its bondholders and the country defaults on its debt. And they are gaming out how to both minimize risks and make the most of any opportunities to profit that might be hiding in the chaos... Bank of America analysts wrote in a note to clients this week that a default in late summer or early fall is “likely,”... T.D. Securities analysts think that the credit rating on U.S. debt is likely to be lowered if negotiations go badly, which could spook some investors.

OK, but how likely is it that the US credit rating or outlook will be lowered?

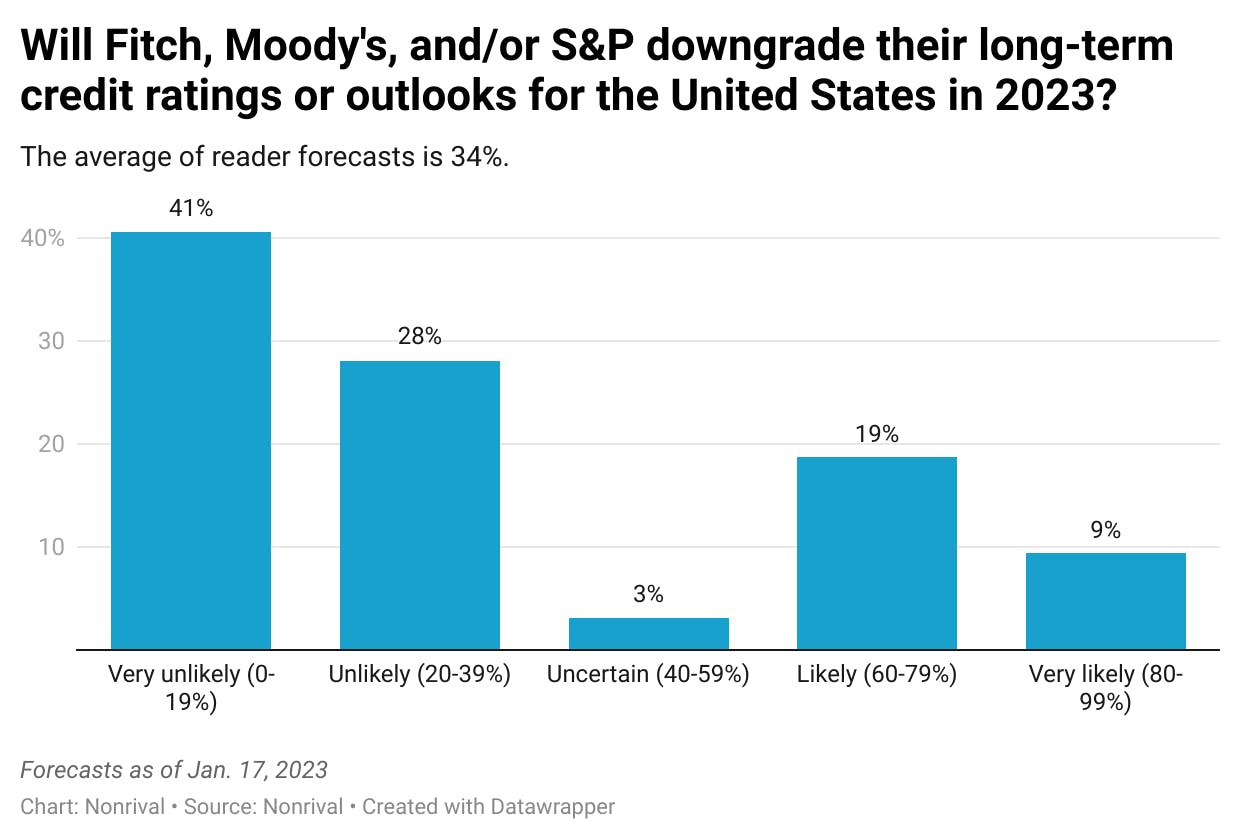

The average Nonrival forecast is 34%, but as you can see below there's a lot of disagreement. Nearly a third of readers see it as more likely than not.

So far, the forecasters on Good Judgment Open are more optimistic—giving just an 18% chance of a downgrade to the US outlook or credit rating. They're also giving just a 3% chance that the debt ceiling is not raised or suspended this year, more optimistic than Kalshi which gives a 9% chance.

The upshot is that even if the debt ceiling is raised this year, there's a real chance the US credit rating or outlook suffers, suggesting some possibility of financial turmoil even if a deal is eventually reached.

Readers' responses

Justifications from readers, sorted by the % forecast they gave

10%: Given the hit Republicans took last time for brinksmanship on this issue it seems unlikely they will repeat their behavior. However, 10% is still much higher than it should be with two sensible political parties.

15%: The Treasury market would move lower if its rating was downgraded. And it hasn’t reflected that fear.

25%: Four outlook or rating changes in the last 12 years by my count, so a 1-in-4 chance. Maybe a shade higher this year? But 25% feels right: some 5-10% chance of an actual breach and a decent additional chance of a non-breach downgrade.

25%: It shouldn't be hard to get 4 [GOP] moderate votes for a discharge petition on a clean increase

60%: I don't think there's any sort of crisis going down--negotiations will happen and the debt ceiling will be raised (for better or for worse). However, these credit agencies may have been itching to downgrade the U.S. for a while due to political destabilization, and this could be their excuse.

95%: Over the past 10 years the credit agencies have downgraded the "outlook" over very minor fights and this upcoming fight is going to be as serious as 2011; if the question was on the rating itself it might be more up in the air but an outlook change is definitely in the cards.

How your forecast compares

The actual average was 34%.

[If you made a forecast by email you would see your personalized comparison here.]

Venture funding keeps falling

In October of last year, Nonrival asked whether US venture capital funding would continue to fall. Specifically, readers forecasted the likelihood that Q4 would be higher than Q3, which was already well off the highs of 2021 and early 2022. The Nonrival reader average was 34%. Notably, you were more pessimistic than traders on Manifold, the play-money prediction market, which gave a 49% chance of Q4 going higher.

In reality, US VC funding dipped even further in Q4, according to PitchBook:

How your forecast scored

The average reader forecast said there was a 34% chance of Q4 VC funding exceeding Q3.

Q4 ended up lower, so it didn't happen, therefore lower forecasts score better.

[If you’d made a forecast via email you’d be seeing your results here.]

Extras

Stuff I worked on...

Grab bag...